Basics

The Overlooked Significance of Financial Stability

.jpeg)

The increasing profitability of a company is undoubtedly important in the context of expected growth in the stock price, but there is another parameter that cannot be overlooked in the analysis of a business – fundamentals.

The financial stability of a company is crucial to its proper functioning. In short, financial stability means that a company has or generates more money than it owes. The greater this disparity, the safer the company.

When assessing a company’s fundamental situation, an investor eliminates or minimizes the risk associated with the company’s liquidity loss, and therefore protects himself from the consequences of its bankruptcy or serious financial difficulties.

To assess a company’s susceptibility to bankruptcy, several important parameters from the latest financial report are usually compared. So let’s do a deep-dive and look at the most popular ones:

1. ratio of current assets to current liabilities;

2. CFO to debt ratio;

3. interest coverage ratio.

The Art of Identifying Quality Companies

If everyone knew how to correctly identify the quality company, such entries would not be necessary. At first glance, the matter may seem quite simple – we are all looking for companies that generate profits, do not report losses and, in short, are developing and moving forward.

Is it wrong? Of course, it’s good – but such an approach is a significant simplification, which may lead to wrong decisions. So let’s analyze the most important factors – and check how to assess the topic of reliability discussed today.

- Ratio of current assets to current liabilities

First and foremost, the ratio of current assets to current liabilities should be examined. Current assets mean everything that the company has in the form of cash or its equivalents, as well as what it can convert to cash in the next twelve months. Current assets will therefore include: banknotes held in cash, funds in a bank account, checks, and short-term government bonds (expiring before the end of the year).

All invoices issued for which receivables have not yet been received and all goods produced that are still in the warehouse will also be included in the assets. While invoices with payment terms of less than twelve months can be treated as a relatively certain source of cash that will be received in the near future, there is a greater problem with goods in the warehouse.

What if the goods have a short shelf life? What if they are outdated and there is no demand for them? What if this product has been sitting in the warehouse for a long time and the chances of selling it are slim? In this case, it is difficult to consider it a real component of the company’s assets that will be converted into cash in the coming months.

Therefore, when estimating the value of a company's assets, it would be a good idea to exclude goods with low liquidity from them; in other words, we should not include inventory in the total value of assets.

This way we will get the value of the company’s current assets, but only those that are liquid and that it can actually use to pay off its obligations. Ah, yes, obligations.

It would not be possible to assess whether the value of a company’s assets is high or low by looking only at their absolute value. In the case of a tiny company, $100,000 will be a high level, while in the case of a large conglomerate, assets worth $10 billion will turn out to be negligible. So every reading always has to be compared to something. That something is the level of current liabilities.

Current liabilities are everything that a company will have to pay within the next twelve months. This includes invoices received but not yet paid to contractors and subcontractors, employee salaries, part of the debt that will be due for repayment in a given year, and all other similar claims.

It is easy to understand that we talk about a financially stable company when it has a surplus of current assets over current liabilities. The greater this surplus, the greater the company's financial liquidity.

The quick ratio is a parameter that determines the ratio of current assets (excluding inventory) to current liabilities. If the quick ratio is 1.2, it means that the company has $1.20 in assets for every $1 in current liabilities. This shows a 20% surplus, indicating that the company’s financial liquidity is not in danger. If the quick ratio is 0.8, it means that the company has only $0.80 in liquid assets for every $1 in current liabilities. In this case, to pay off all its liabilities in the coming year, the company must sell some inventory or take out additional loans.

Of course, the situation does not look dramatic yet, but we can already talk about slightly lower liquidity than in the case of a company with a quick ratio of 1.2.

Assessing the Long Term Solvency

However, a positive current assets to current liabilities ratio is not enough to conclude that the company is financially stable and there is no risk of losing liquidity. Assets, even in the form of cash, may not necessarily come from operating activities but, for example, from a loan. This would be a situation in which one liability, such as employee salaries, is paid with other liabilities, such as long-term debt.

Therefore, a company’s fundamentals must be examined using other indicators as well.

One of them is to compare the amount of cash generated from operating activities (cash from operations) with the company’s total debt. This way, the investor can be sure that the company has enough cash from operating activities to pay off the entire debt within a specified number of years.

Therefore, we smoothly move on to the second point of today’s text, i.e….

2. CFO to debt ratio

The CFO to debt ratio above 0.3 is considered attractive. It means that for every $1 of debt, the company generates $0.30 in cash from operating activities each year. This suggests that after three years, it can repay its all debt.

In a world of low interest rates, paying off the full debt is not a priority for most companies, but the annual cost of servicing that debt is crucial for the company’s solvency.

3. Interest coverage ratio

The interest coverage ratio tells investors how many years a company can pay off the interest on its current debt with one year of net income. A ratio of 4 means that the company can pay off the interest on its debt for the next four years with its last generated net income, indicating a significant safety buffer.

To evaluate the fundamental stability of a company, a range of other individual or aggregate indicators can be used.

For example, investors often compare the return on invested capital to the cost of obtaining that capital (ROIC vs. WACC), or the level of debt to the company’s assets (total debt vs. total assets).

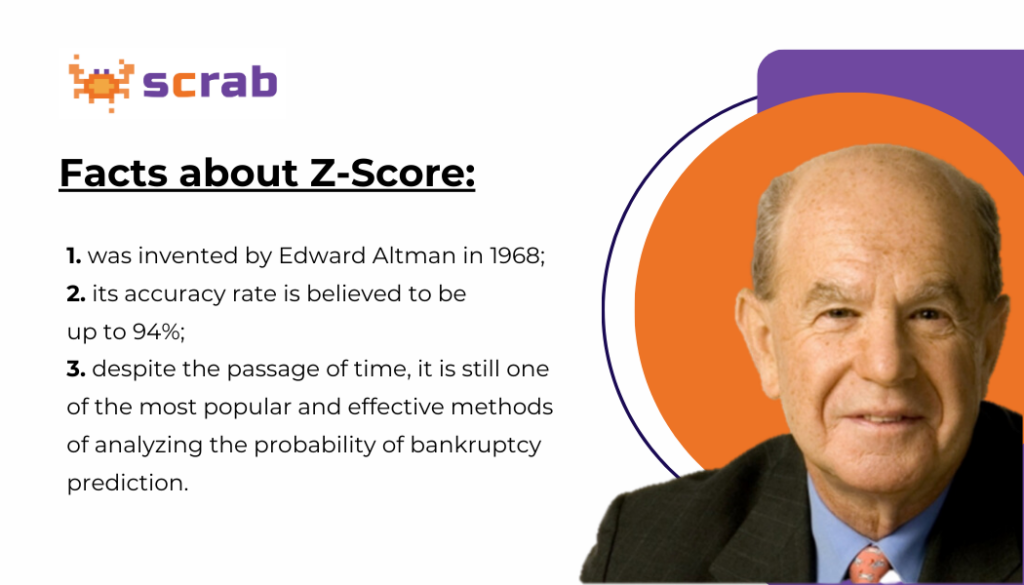

Popular and well-tested aggregate indicators are formulas developed years ago by economists such as Dr. Edward Altman and Dr. James Ohlson, which help estimate a company’s bankruptcy risk in a simple way.

However, regardless of whether the investor applies an evaluation composed of a series of separate indicators or an evaluation made using ready-made formulas, this aspect remains significant from the point of view of the behavior of a company’s stock price, because the more leaky the ship, the more quickly and numerous the passengers will flee it.

Summing Up…

It is an open secret that when there are disturbances in the economy or on the market, companies with weak fundamentals are the first to suffer the most extensive declines, potentially facing survival problems in difficult times characterized by lower demand, more expensive credit, higher production costs, etc.

On the other hand, the fundamental situation of a company does not necessarily translate into an increase in its stock prices. The company may still be financially stable, but may have lost its ability to generate growing revenues in the meantime. Why would investors pay more for its shares then?

Evaluating the fundamentals remains a crucial element of analysis, but its goal is not to maximize profits resulting from rising stock prices, but to secure investors against the purchase of companies susceptible to bankruptcy.

Start your free trial

Start your 7-day free trial